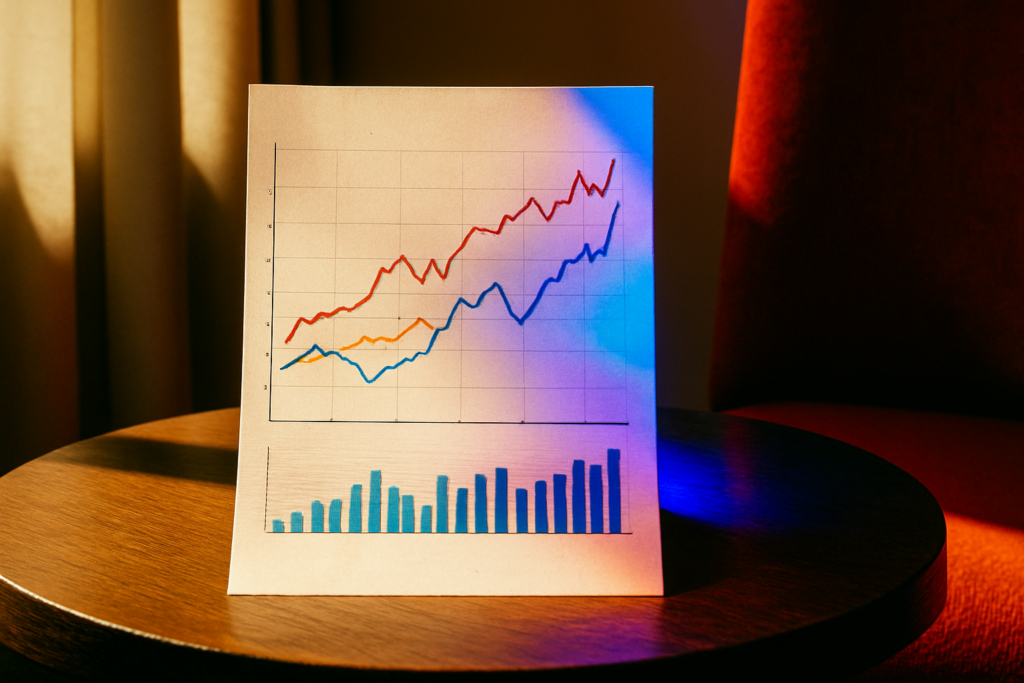

Shifting Power Centers

The global economic center of gravity is steadily tilting east and south. Asia is in expansion mode China still commands major influence, but India and Southeast Asia are gaining fast. Their growth isn’t coming from cheap labor alone. We’re seeing stronger domestic markets, digital infrastructure booms, and regional cooperation that bypasses older Western dependent systems. These economies aren’t waiting for the world to catch up they’re building their own networks of trade, innovation, and capital.

Africa’s rise is more recent, but just as important. With a young population and increasing investment especially in infrastructure and green tech the continent is carving out a larger share of global trade. Regional integration efforts, like the African Continental Free Trade Area, are helping economies speak with a louder voice.

Meanwhile, traditional Western giants the U.S. and much of Europe are looking at a slower decade. Aging populations, policy gridlock, and post industrial transitions are putting a brake on growth. They’re not out of the game, but the era of automatic dominance is clearly over.

The result? A more multipolar economy defined by emerging players who move fast, build local, and think regional at scale.

Technology as a Key Driver

Disruption isn’t coming it’s already here. AI, automation, and quantum computing are no longer headline fluff. They’re cutting into how we work, hire, and build businesses. Routine and even moderately complex tasks are now being handed off to machines. For labor markets, that means fewer repetitive roles and more pressure to upskill. The safety net? Adaptability.

Digital currencies are hitting their stride too. It’s not just crypto bros anymore. Governments are rolling out central bank digital currencies (CBDCs), while consumers get comfortable with wallets that never touch a bank. Transaction speed, cross border payments, and financial inclusion are improving. The flip side: old regulatory models are trailing behind, and the risk of fragmentation looms.

Meanwhile, tech innovation isn’t locked in one zip code. Hubs are springing up everywhere from Lagos to Bangalore to São Paulo. Talent exists everywhere now, and infrastructure is catching up. Silicon Valley still matters, but it doesn’t own the spotlight anymore. For investors and innovators, that changes everything.

To dive deeper into where this momentum is taking the global economy, explore the full take here: global economy predictions.

Geopolitical Tensions and Economic Realignment

The age of stable trade alliances is fading. In its place: a web of shifting partnerships, tariff chess games, and regional power blocs getting more assertive. The old assumption that global trade would march toward seamless integration is now officially outdated.

In this new landscape, countries are forming tighter regional packs think ASEAN+3, the African Continental Free Trade Area, or Latin American commercial corridors. These alliances create quicker decision zones that sidestep the slow moving machinery of global pacts like the WTO. Trade is becoming more politically selective. Who you trade with increasingly depends on who you align with.

This doesn’t signal the end of globalization, but rather a harder, more fragmented version of it. Power is pooling closer to home. That means supply chains are getting shorter, and local economic resilience is becoming a top national goal.

For businesses and policymakers, the memo is clear: don’t just think globally think strategically regional. The future of trade will be built on flexibility, not uniformity.

Climate Economics and Sustainability Demands

2024 marks a tipping point for green tech. Investment in renewables, energy storage, and carbon capture has officially outpaced funds flowing into fossil fuel sectors. Governments, venture capital, even oil giants are pumping money into cleantech because the returns are beginning to look steadier than oil futures. The narrative has shifted: clean energy isn’t just about climate morality anymore. It’s about market logic.

At the regulatory level, carbon pricing is growing teeth. More countries are putting a dollar sign on emissions, and companies are adapting fast. ESG (Environmental, Social, Governance) standards aren’t optional paperwork anymore they’re guiding where capital goes. Businesses slow to adjust are bleeding talent and investor confidence.

Meanwhile, some regions are pulling ahead by rethinking infrastructure entirely. Northern Europe and parts of East Asia are building climate adaptive cities resilient grids, flood smart architecture, public transport rooted in sustainability. These are no longer lofty goals. They’re survival planning.

For any global economic forecast, watching how climate and commerce collide is no longer a side note. It’s the main plot.

Demographic and Workforce Shifts

By 2035, the global workforce will look nothing like it does today. Developed countries are aging fast. Fewer workers, more retirees this means labor shortages, higher wage pressure, and the need to automate parts of the economy. Governments in Europe, Japan, and North America are already tinkering with retirement ages and immigration policy just to keep key industries afloat.

At the same time, countries with younger populations think India, Nigeria, Indonesia are becoming hotbeds of innovation and digital entrepreneurship. Their youth heavy demographics aren’t just a numbers game; these regions are becoming launchpads for next gen startups, local tech platforms, and cross border collaboration. Youth centric economies move fast and break things even legacy systems.

Remote work has gone from emergency solution to embedded feature. Millions of professionals now expect flexibility, and countries are racing to attract digital nomads with visa programs and tax perks. The long term outcome: location will matter less than ever for high skill roles, and workforces will continue to decentralize.

In short, the workforce is splitting in two directions aging centers managing decline, and youthful regions pushing experimentation. The winners? Those who adapt fast and train even faster.

What Matters Most for the Next Decade

The global economy is poised for dramatic evolution over the coming decade and the players who thrive will be those who can anticipate and adapt. As disruption accelerates, traditional growth models will no longer be enough. Businesses, governments, and institutions must pivot to meet the demands of a transformed economic landscape.

Agility Over Bureaucracy

In the face of unprecedented volatility, agility is a critical asset. Moving faster than outdated policy cycles will separate thriving economies from stagnant ones.

Policy lag is a risk: Rapid innovation outpaces regulation

Responsive leadership needed: Timely decision making will define resilience

Short term flexibility, long term vision must coexist in strategy

Collaboration as a Competitive Edge

Global challenges climate, migration, technological chaos require cross border problem solving. The most successful economies will be those willing to cooperate beyond traditional alliances.

Trade diplomacy will intensify, especially in tech and energy

Private public partnerships will become central to economic agility

Emerging markets will redefine economic blocs and influence

Tech and Trade Insight is Non Negotiable

Understanding the pace and direction of tech disruption is no longer optional it’s essential. The leaders of tomorrow will interpret data, trends, and geopolitical currents in real time.

Artificial intelligence and automation will keep reshaping industries

Decentralized finance (DeFi), digital currencies, and blockchain will disrupt banking norms

Supply chain intelligence and trade analysis will be key to maintaining a competitive edge

For a deeper exploration of these dynamics, visit: Global Economy Predictions