Current State of the Global Automotive Market

The automotive market continues to experience significant shifts, driven by advancements in technology and changing consumer preferences. Let’s delve deeper into key aspects shaping this market.

Overview of Market Size and Growth

In 2022, the global automotive market’s size reached approximately $3.8 trillion. A compound annual growth rate (CAGR) of 3.6% between 2023 and 2028 is projected by industry experts.

Two primary factors contributing to this growth are the increasing adoption of electric vehicles (EVs) and the continuous development of autonomous driving technology. This trajectory signals substantial ongoing transformations within the market.

Key Regions and Their Performances

China, the United States, and Europe dominate the global automotive market. These regions collectively account for more than two-thirds of the overall market share.

- China: In 2022, China produced over 21 million passenger cars, representing nearly 30% of the world’s total production. The country’s aggressive push for EV adoption has bolstered its market performance.

- United States: The US remains a key player, with strong demand for pickup trucks and SUVs. In 2022, the annual vehicle sales volume in the US reached around 14.6 million units.

- Europe: Europe’s emphasis on reducing carbon emissions has accelerated the switch to EVs. In 2022, EV sales in Europe grew by 12%, making up roughly 16% of all new car registrations.

Insights into these key regions help us understand the diverse dynamics influencing the global automotive market.

These vectors of market size, growth, and regional performance provide a clear view of the current state and evolving trends within the global automotive sector.

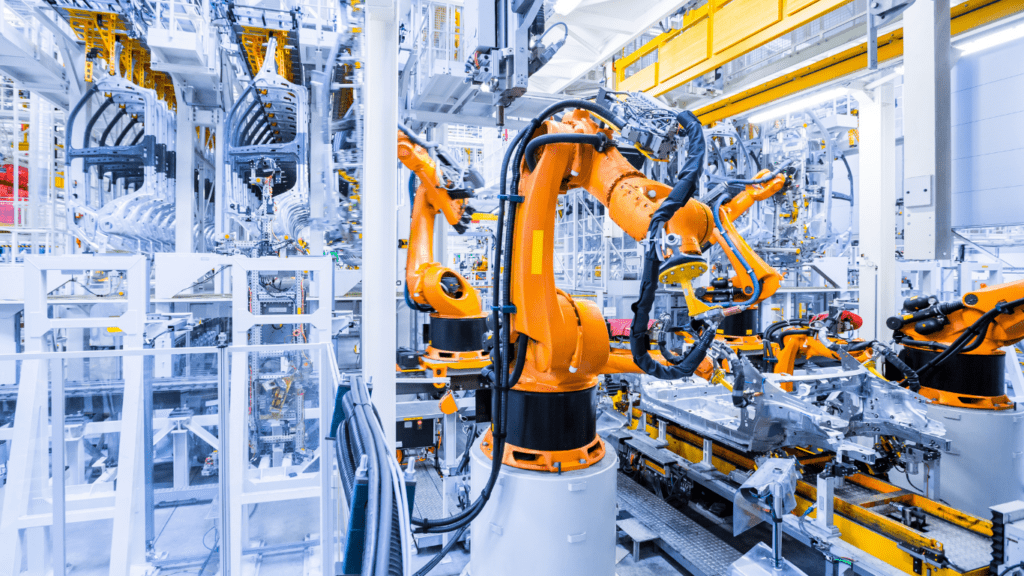

Major Trends in Vehicle Technology

The global automotive market’s technological landscape has seen significant shifts. Key advancements include electric and hybrid vehicles and autonomous driving technologies.

Electric and Hybrid Vehicles

Electric and hybrid vehicles are gaining traction. International Energy Agency (IEA) data shows global EV sales reached 3 million units in 2020, a 41% increase from 2019.

Advances in battery technology, like lithium-ion batteries, improve range and reduce costs. Governments offer incentives like tax breaks and grants to boost adoption.

For instance, in Norway, 54.3% of new car sales in 2020 were electric. Automakers, including Tesla, Nissan, and BMW, invest heavily in expanding their electric vehicle lineups.

Autonomous Driving Technologies

Autonomous driving technologies are revolutionizing the market. These systems fall into six levels, from Level 0 (no automation) to Level 5 (full automation).

Companies like Waymo, Tesla, and Uber are testing and implementing advanced driver-assistance systems (ADAS), including lane-keeping assist, adaptive cruise control, and self-parking.

The global autonomous vehicle market is projected to reach $556 billion by 2026, driven by safety improvements and regulatory support. However, challenges remain, such as regulatory hurdles and the need for robust cybersecurity measures.

Environmental Regulations Impacting the Industry

The automotive industry faces numerous environmental regulations aimed at reducing the sector’s carbon footprint. These regulations influence vehicle design, manufacturing processes, and market dynamics.

Emission Standards Worldwide

Emission standards vary globally, affecting vehicle production and sales.

In the European Union, Euro 6 standards impose stringent limits on nitrogen oxides (NOx) and particulate matter emissions, requiring advanced technologies like:

- selective catalytic reduction (SCR)

- diesel particulate filters (DPF)

In the United States, the Corporate Average Fuel Economy (CAFE) standards target fuel economy improvements, pushing manufacturers to produce more fuel-efficient vehicles and adopt hybrid and electric powertrains.

China 6 standards, similar to Euro 6, focus on reducing air pollutants from vehicles in one of the world’s largest automotive markets. These standards compel automakers to adopt cleaner technologies to comply with diverse regional regulations.

Automotive Manufacturers’ Adaptations

Automakers are adapting to these stringent environmental requirements through innovation and investment. Companies like Tesla and Nissan are leading the charge by expanding their electric vehicle offerings.

Traditional manufacturers such as Ford and General Motors are also increasing their EV lineups and developing hybrid models to meet regulatory demands and consumer preferences.

Additionally, investments in research and development focus on enhancing battery efficiency, reducing vehicle weight, and improving aerodynamics.

Automakers are deploying advanced driver-assistance systems (ADAS) to meet safety and emissions standards while enhancing fuel economy and reducing emissions. These adaptations highlight the industry’s commitment to sustainability and regulatory compliance.

Market Challenges and Opportunities

Market challenges and opportunities shape the global automotive landscape, impacting strategies and growth.

Trade Policies and Their Effects

Trade policies affect automotive market dynamics, influencing costs and supply chains. Tariffs between the US and China have raised vehicle and component prices, impacting consumer prices and automaker profits.

The EU’s trade agreements with Japan and South Korea offer tariff reductions, enhancing competitiveness for European manufacturers. NAFTA’s replacement with USMCA modifies trade rules in North America, affecting labor costs and regional auto production.

Emerging Markets and Future Prospects

Emerging markets present significant growth opportunities for automakers. India’s expanding middle class and government incentives drive vehicle demand, contributing to a projected 6% CAGR in the passenger vehicle segment.

Southeast Asia’s automotive market grows swiftly, with Indonesia and Thailand leading in production and sales.

Latin America experiences a resurgence in automotive sales, with Brazil’s market recovering through economic stabilization and increased consumer confidence. Automakers investing in these regions capitalize on local demand while diversifying global operations.